Offshore Trusts in Miami: What You Need to Know

Offshore Trusts in Miami: What You Need to Know

Blog Article

Understanding the Advantages and Challenges of Developing an Offshore Count On for Property Protection

When considering property protection, establishing an overseas count on could appear attractive. It offers privacy, potential tax advantages, and a method to shield your assets from creditors. The intricacies and expenses involved can be frightening. You'll require to navigate lawful considerations and conformity concerns that differ across territories. Are you prepared to evaluate these benefits versus the challenges? The next actions could significantly affect your monetary future.

What Is an Offshore Trust Fund?

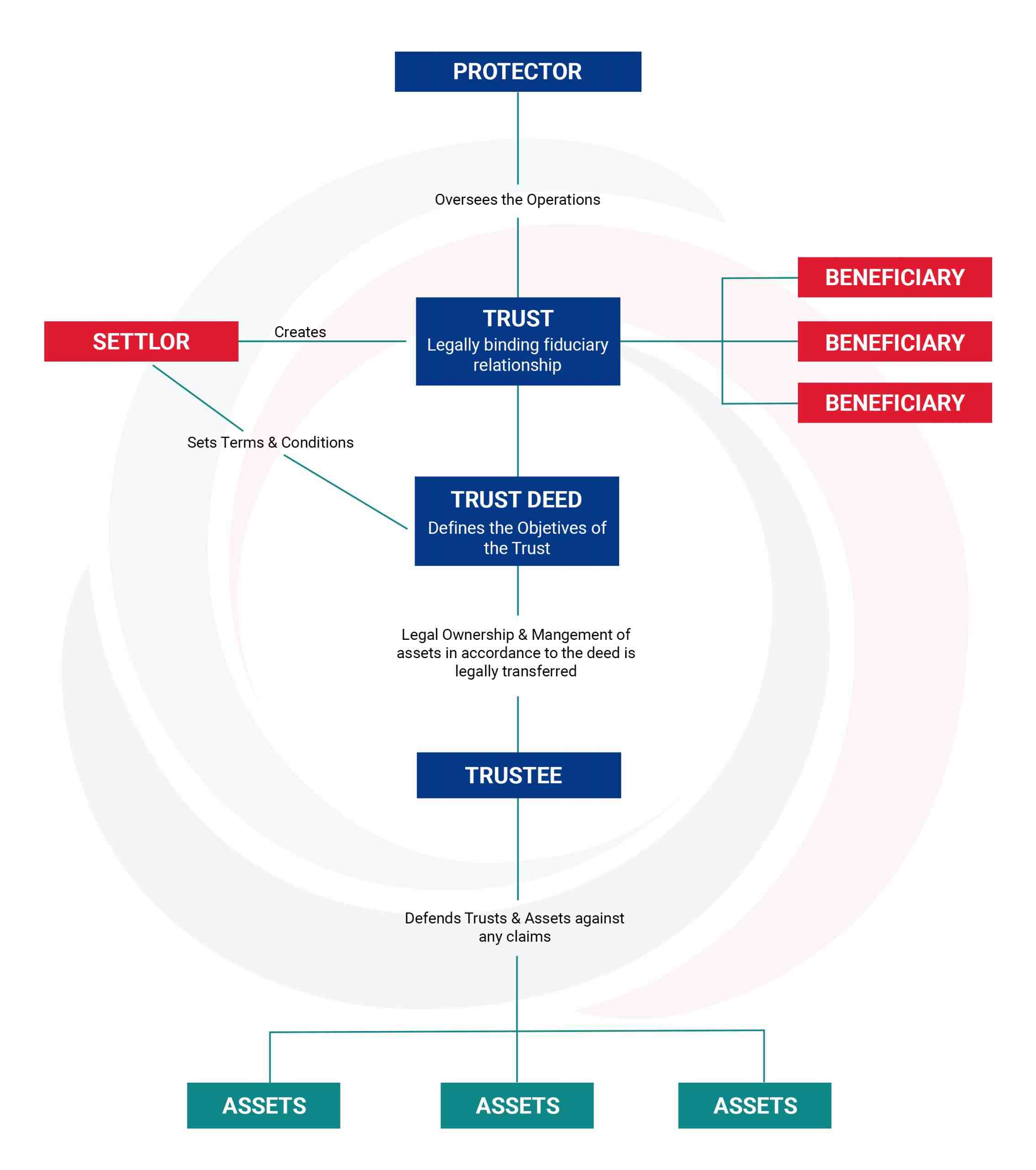

An overseas depend on is a legal arrangement where you transfer your assets to a depend on that's developed outside your home country. You can assign a trustee, who will supervise the depend on according to your desires.

Trick Benefits of Offshore Trust Funds for Possession Defense

When thinking about overseas trusts for asset security, you'll locate several essential advantages that can profoundly influence your monetary protection. These depends on provide enhanced personal privacy, tax advantages, and a lawful shield from creditors. Comprehending these advantages can help you make educated decisions about your assets.

Improved Privacy Protection

Several individuals seek offshore trust funds not just for financial advantages, but also for enhanced privacy defense. By developing an overseas trust fund, you can divide your personal assets from your public identity, which can discourage undesirable attention and possible lawful insurance claims. A lot of offshore territories provide strong discretion laws, making it challenging for others to access your count on details. This included layer of personal privacy safeguards your economic events from prying eyes, whether it's lenders, litigants, or perhaps snoopy next-door neighbors. Additionally, you can preserve greater control over exactly how your assets are managed and dispersed without disclosing delicate details to the public. Eventually, an offshore trust fund can be a powerful device for protecting your individual privacy while safeguarding your wide range.

Tax Obligation Advantages and Motivations

Beyond boosted privacy protection, offshore counts on also provide considerable tax benefits and incentives that can furthermore enhance your economic strategy. By establishing an offshore depend on, you may enjoy minimized tax obligations depending on the territory you choose. Lots of countries give desirable tax rates or exemptions for trusts, permitting your assets to grow without the concern of extreme taxation.

Legal Shield From Creditors

Establishing an overseas count on offers you a powerful legal guard versus financial institutions, ensuring your possessions continue to be secured when faced with financial difficulties. By putting your properties in an offshore count on, you create a barrier that makes it hard for financial institutions to access them. This legal structure can prevent possible legal actions and claims, as financial institutions might locate it testing to penetrate the depend on's defenses. In addition, overseas depends on often run under different lawful jurisdictions, which can give more benefits in asset security. You acquire comfort, knowing your wealth is safeguarded from unpredicted financial troubles. It is essential to comprehend the lawful demands and effects to completely benefit from this strategy, making certain conformity and effectiveness in protecting your properties.

Lawful Considerations When Establishing an Offshore Depend On

When you're establishing an offshore count on, comprehending the legal landscape is essential. You'll need to thoroughly pick the ideal territory and guarantee compliance with tax guidelines to secure your properties effectively. Ignoring these aspects can result in costly errors down the line.

Jurisdiction Option Requirements

Choosing the ideal jurisdiction for your offshore depend on is crucial, as it can significantly affect the efficiency of your possession defense method. You'll wish to take into consideration the lawful framework, security, and online reputation of potential territories. Seek nations with solid asset security legislations and a solid judiciary. The simplicity of count on establishment and continuous management additionally matters; some territories provide streamlined procedures. In addition, evaluate any type of personal privacy legislations that protect your info, as confidentiality is usually a key motivator for choosing an offshore trust. Finally, keep in mind to assess the political and economic stability of the territory, as these aspects can affect the long-lasting protection of your possessions. Prioritizing these requirements will help guarantee your chosen territory lines up with your goals.

Conformity With Tax Obligation Rules

Understanding compliance with tax regulations is vital for the success of your overseas trust fund. You'll need to acquaint on your own with both your home nation's tax regulations and those of the offshore jurisdiction. Stopping working to report your overseas trust fund can lead to extreme charges, consisting of hefty penalties and potential criminal fees. Ensure you're filing the needed types, like the internal revenue service Type 3520, if you're a united state citizen. In addition, maintain thorough records of trust purchases and circulations. Consulting a tax expert who focuses on offshore trusts can help you browse these complexities. By remaining compliant, you can enjoy the benefits of property security without running the risk of lawful consequences. Keep in mind, proactive preparation is essential to maintaining your trust's stability and performance.

Prospective Tax Advantages of Offshore Trusts

While many individuals consider overseas trusts mainly for possession security, they can additionally supply significant tax obligation benefits. By placing your possessions in an offshore depend on, you could gain from extra desirable tax obligation therapy than you 'd obtain in your home nation. Several territories have low or zero tax rates on earnings produced by properties held in these trusts, which can bring about considerable cost savings.

In addition, if you're a non-resident beneficiary, you might prevent certain neighborhood taxes totally. This can be specifically beneficial for those looking to preserve wide range throughout generations. Furthermore, overseas trust funds can offer versatility in dispersing earnings, potentially permitting you to time circulations for tax obligation effectiveness.

Nonetheless, it's necessary to speak with a tax obligation expert aware of both your home country's legislations and the offshore territory's guidelines. Making the most of these potential tax advantages needs careful preparation and conformity to assure you stay within lawful limits.

Obstacles and Risks Connected With Offshore Trusts

Although offshore trust funds can offer numerous advantages, they additionally feature a selection of obstacles and threats that you ought to thoroughly consider. One significant difficulty is the complexity of establishing and maintaining the trust fund. You'll require to browse numerous legal and regulatory needs, which can be lengthy and might require professional guidance.

In addition, expenses can rise promptly, from lawful fees to continuous management expenses. It's also vital to identify that overseas counts on can bring in analysis from tax authorities. Otherwise structured appropriately, you might deal with charges or increased tax obligation responsibilities.

Moreover, the capacity for adjustments in laws or political climates in the territory you have actually picked can position threats. These modifications can impact your trust fund's efficiency and your accessibility to assets. Inevitably, while overseas trusts can be advantageous, comprehending these difficulties is crucial for making educated decisions concerning your asset security technique.

Picking the Right Territory for Your Offshore Trust

Exactly how do you choose the right territory for your overseas trust fund? Begin by thinking about the legal framework and asset protection laws official statement of potential territories. Search for places understood for strong personal privacy securities, like the Cook Islands or Nevis. You'll additionally wish to assess the jurisdiction's credibility; some are a lot more highly regarded than others in the monetary world.

Following, think regarding tax obligation implications. Some jurisdictions offer tax obligation benefits, while others might not be as beneficial. Offshore Trusts. Access is another element-- choose a place where you can quickly interact with trustees and legal experts

Ultimately, consider the political and financial security of the jurisdiction. A steady environment guarantees your assets are less most likely to be impacted by unexpected modifications. By carefully evaluating these aspects, you'll be much better equipped to pick the appropriate territory that lines up with your property security goals.

Steps to Developing an Offshore Trust Effectively

Developing an offshore trust effectively needs careful preparation and a series of critical actions. You need to choose the ideal jurisdiction based on your property security objectives and lawful needs. Study the tax ramifications and personal privacy legislations in possible places.

Next, select a respectable trustee who recognizes the subtleties of overseas depends this link on. This individual or organization will manage the trust and guarantee compliance with local policies.

When you've picked a trustee, draft an extensive count on deed describing your intents and the recipients included. It's important to seek advice from with lawful and economic advisors throughout this procedure to validate whatever aligns with your goals.

After wrapping up the documentation, fund the trust fund by moving properties. Maintain interaction open with your trustee and evaluate the depend on occasionally to adjust to any type of adjustments in your situation or appropriate laws. Adhering to these steps vigilantly will help you establish your overseas trust fund successfully.

Frequently Asked Concerns

Just how much Does It Price to Establish an Offshore Trust?

Establishing up an overseas count on commonly sets you back in between $5,000 and $20,000. Elements like complexity, jurisdiction, and specialist costs impact the overall rate. You'll want to budget plan for ongoing upkeep and lawful expenses also.

Can I Be Both the Trustee and Recipient?

Yes, you can be both the trustee and beneficiary of an offshore trust fund, yet it's necessary to understand the lawful implications. It may make complex possession security, so consider seeking advice from a specialist for assistance.

Are Offshore Trusts Legal for United States Citizens?

Yes, offshore depends on are lawful for U.S. residents. Nevertheless, you have to abide by tax reporting demands and guarantee the depend on aligns with U.S. legislations. Consulting a lawful expert is crucial to browse the complexities involved.

What Takes place if My Offshore Count On Is Tested?

If your overseas depend on is tested, a court might inspect its legitimacy, possibly bring about property healing. You'll require to supply proof supporting its validity and objective to prevent any type of claims successfully.

How Do I Pick a Trustee for My Offshore Trust?

Picking a trustee for your offshore trust includes evaluating their experience, track record, and understanding of your goals. Look for a person trustworthy and knowledgeable, and make sure they know with the laws controling web link offshore trusts.

Report this page